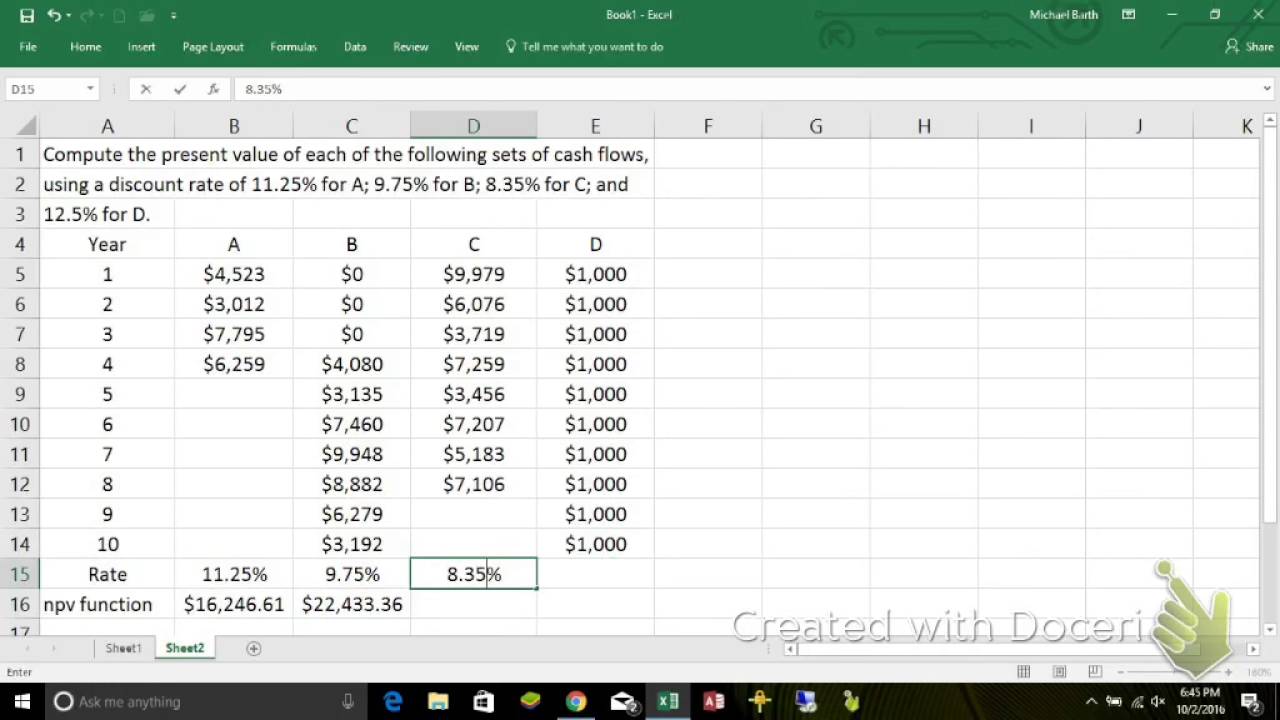

Present value of future cash flows calculator excel

NPV Todays value of expected future cash flows Todays value of invested cash An NPV of greater than 0 indicates that a project has the. PV CF 1 r t.

Calculate Npv In Excel Net Present Value Formula

Instead of using the above formula the future value of a single cash flow can be calculated using the.

. Net Present Value Understanding the NPV function. Calculating the net present value NPV andor internal rate of return IRR is virtually identical to finding the present value of an uneven cash flow stream as we did in Example 3. Erhalten Sie den zukünftigen Wert einer Investition.

Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. Present value PV is the current value of an expected future stream of cash flow. Net present value NPV is the value of a series of cash flows over the entire life of a project discounted to the present.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Enter the present value formula. FV Rate nper pmt pv typ rate Der Zinssatz pro Periode.

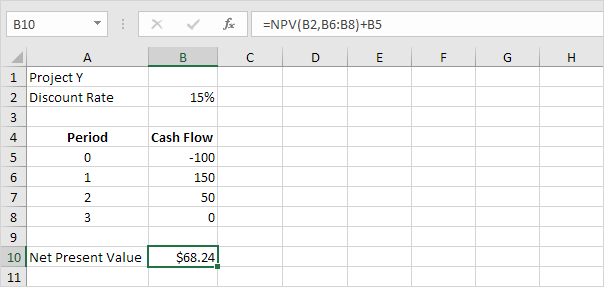

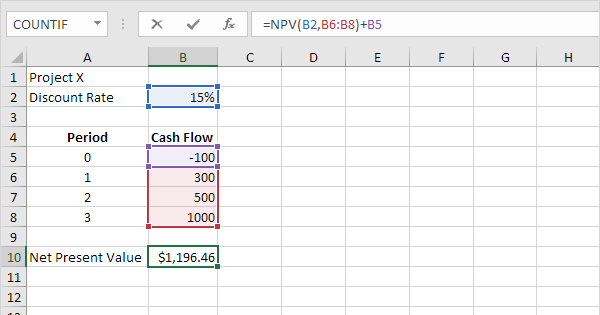

Ad Get 3 cash flow strategies to stop leaking overpaying and wasting your money. Net Present Value NPV is the value of all future cash. The correct NPV formula in Excel uses the NPV function to calculate the present value of a series of future cash flows and subtracts.

In the simplest terms. In simple terms NPV can be defined as the present. The discount rate is the rate for one period assumed to be annual.

Ad QuickBooks Financial Software. When calculating the present value of annuity ie. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Present Value is calculated using the formula given below. Enter your name and email in the form below and download the free template now. F V n 0 N C F n 1 i n.

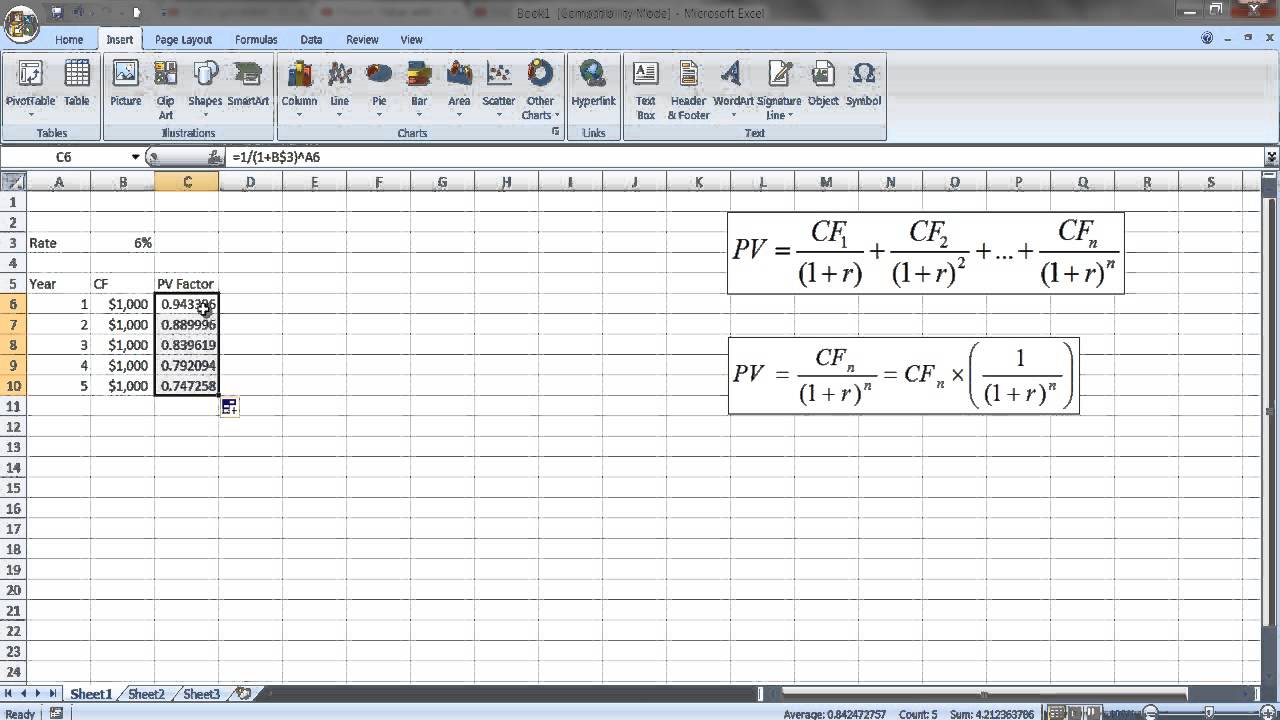

Click the blank cell to the right of your desired calculation in this case C7 and enter the PV formula. Calculate the present value of all the future cash flows starting from the end of the current year. NPV calculates the net present value NPV of an investment using a discount rate and a series of future cash flows.

A series of even cash flows the key point is to be consistent with rate and nper supplied to a PV formula. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Heres how to set up Future- and Present-Value formulas that allow compounding by using an interest rate and referencing cash flows and their dates.

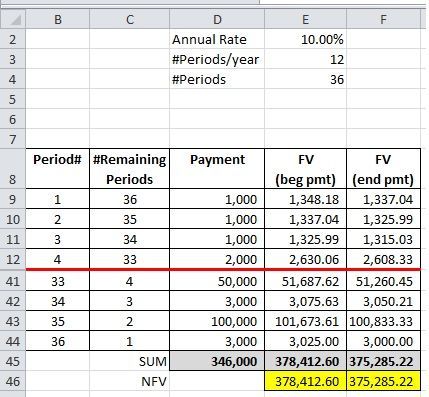

NPV C11C5C9 the NPV function uses a discount rate and series of cash flows to find out the net present value of a financing system. We can use Excel NPV to calculate the present value of the variable cash flows then use Excel FV to calculate the future value of the NPV -- what I call NFV. I now have to include the fact that in addition to the cash flow in 2023 I also have all of these other cash flows that started in 2024 into the future.

Our Business Consultants Will Partner With You To Build Financial and Operational Success. Download the Free Template. If our total number of periods is N the equation for the future value of the cash flow series is the summation of individual cash flows.

To get a correct. I have to discount those back to 2018. For example if you want a future value of 15000 in 5 years time from an investment which earns an annual interest rate of 4 the present value of.

F V n C F n 1 i n n. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Using the Excel FV Function to Calculate the Future Value of a Single Cash Flow.

93 of small business owners are constantly leaking money on useless and unnoticed things. Present value can be calculated relatively quickly using Microsoft Excel. Rated the 1 Accounting Solution.

PV rate nper pmt fv. C11 is the discount rate.

Future Value Of Cash Flows Function Microsoft Tech Community

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Present Value Multiple Cash Flows In Excel Youtube

How Does The Net Present Value Of Future Cash Flows Work In Excel Excelchat

Npv Formula In Excel In Easy Steps

Present Value Of Cash Flows Calculator

The Difference Between Annual Vs Monthly Npv In Excel Excelchat

Npv Formula In Excel In Easy Steps

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

How To Use The Excel Npv Function Exceljet

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Formula For Calculating Net Present Value Npv In Excel

Computing The Present Value Of Future Cash Flows Using The Excel Pv Function Youtube

Excel S Npv Function For Pv Of Uneven Cash Flows Youtube

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

Using Pv Function In Excel To Calculate Present Value